Microsoft Dynamics NAV Payroll is a tricky part of the system and a tricky part of business. If you’re having issues with Payroll, you definitely want to contract with some experts to help you out. But, there is a tool in the system that will give you some extra insight into what might be going on, which could allow you to resolve small errors.

For today’s example, we’re going to be using Classic Client, as the UI to this tool still works a smidgen better (at least in the version I’m using) in Classic.

The Background

Linda Martin, our employee, is a salaried, biweekly person, with all the usual payroll setup. But, your company just got notice that your tax rate for Georgia has been changed by the state, going up 0.2% across the board. You think you’ve updated the correct places in the system, but their GA SIT amount on their paycheck is the same amount as last Pay Period. You need to print checks, and the clock is ticking: How do you figure out why the rate is wrong?

Enable Calc Trace

For this step, you need to either be a SUPER user or ask a SUPER user to perform this process.

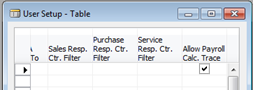

You need to open Table 91 – User Setup, via the Object Designer under the Tools menu. Locate your user record and locate the column Allow Payroll Calc. Trace:

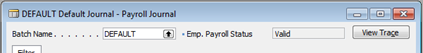

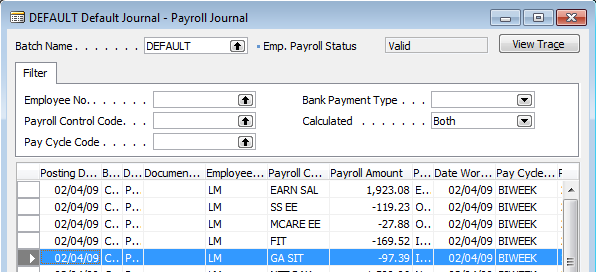

Make sure not to change anything else while in here. You’ll know this setting is correct if you see a new button (View Trace) on the Payroll Journal:

Tracing a Payroll Control

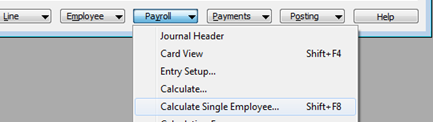

Now that you have permission to use the Trace system, we need to recalculate our GA SIT entry for Ms. Martin. To do this, we’ll need to select the GA SIT line for Employee LM, then under the Payroll button, select Calculate Single Employee (rather than “Calculate…”):

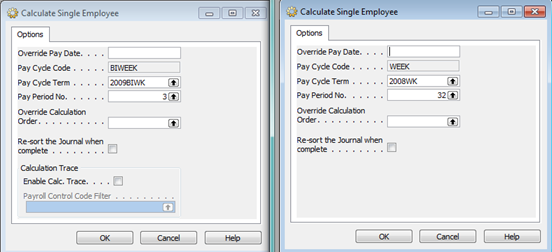

You’ll see a new set of options (shown on the left). If you see the blank space as shown on the right, the Enable Calc Trace was not completed correctly:

In our case, we want to check the Enable Calc. Trace box, then select GA SIT for our Payroll Control Code Filter, then press OK.

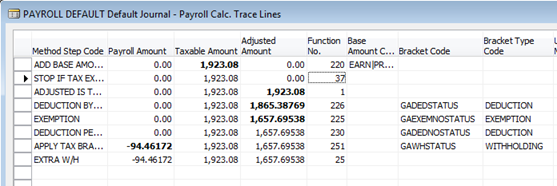

Once that completes, you’ll want to press the View Trace button on the Payroll Journal. You’ll see the Payroll Calc. Trace Lines form. I’ve re-arranged mine a little to better show what we’ll need, but it will roughly look like:

We’re most concerned about where her -94.46 came from, so note that it first shows up on the line APPLY TAX BRA…. Off to the right, we’ll notice that it’s using the Bracket GAWHSTATUS type WITHHOLDING. This tells us where we’ll find the Tax Rates.

Tracking Down the Rate “Bracket”

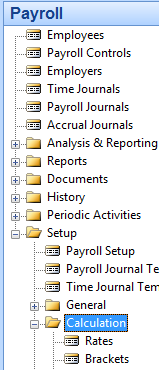

You can check the Employee Card, Payroll button, Tax Auth. Info to see which Filing Status Code the employee has if you don’t know already. We know Ms. Martin is ‘M BOTHWORK’. So, we’re going to go review the GAWHSTATUS Bracket details. It can be found under Payroll’s Setup -> Calculation -> Brackets option:

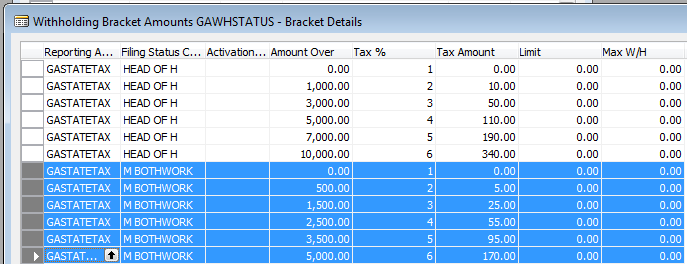

Locate the GAWHSTATUS bracket and press the Details button. In our demo database (where the rates are not likely current, do not use these screenshots as your configuration settings), we can see our rates are:

We’ll go ahead and update all the Tax % columns to our new state supplied rates. We then can re-run any form of Calculate against Ms Martin in the Payroll Journal and we’ll see that it is now withholding the correct amount:

This post won’t solve many of your common payroll issues, but it might help you identify what’s going wrong when something is only slightly off. You’ll be able to provide more detailed information to your Payroll Support Team. Which, you have, right?